QCA Principles

The following information is based on the Corporate Governance Report from the 2025 Annual Report.

How Cohort applies this principle

The Board, led by the Chairman, sets the Group’s strategic direction and is responsible to Cohort’s stakeholders for the leadership, oversight and long-term success of the Group.

The Group’s purpose, business model and strategy is set out in our Strategic report. We believe this promotes long-term value for our shareholders as demonstrated by our five years’ financial performance and our key performance indicators which are shown for the last three years.

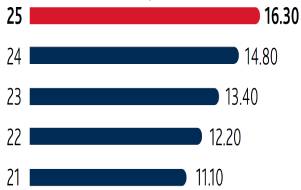

Our progressive dividend policy and share performance over the last five years are also indicators of long-term value for our shareholders with total shareholder return shown here:

We believe our strategy will continue to deliver value for shareholders in both the medium and the long term.

Some of the key activities which we have undertaken to promote long-term value are set out in our Section 172 statement.

How Cohort applies this principle

The Group has a strong ethical culture, supported by our policies and processes as further described in the Governance section of our Sustainability report.

How Cohort applies this principle

Cohort places a great deal of importance on communication with all shareholders and details of how we achieve this are set out in our Stakeholder engagement report.

The Company meets with its institutional shareholders and analysts and receives regular feedback from its institutional shareholders, either directly or via its NOMAD, Investec. The Board is keen to ensure that shareholders are provided with the opportunity to engage with the Board and has continued to host live Q&A sessions following any financial announcements. Recordings of these sessions can be accessed on our website.

We also consider any voting guidance reports received from organisations such as Institutional Shareholder Services.

See Stakeholder Engagement for further details.

How Cohort applies this principle

Consideration of all of the Group’s stakeholders is an integral part of the Board’s discussions and decision making. Our stakeholders include shareholders, our employees, customers, partners, suppliers, and local communities. Further details of how we engage and respond to the needs, interests and expectations of our stakeholders are set out in our Stakeholder engagement report.

We believe that our employees are the key to our success. We are not a capital-intensive business but depend upon the skills, capabilities and flexibility of our employees, and our business model depends upon us being agile and responsive (see Social in our Sustainability report). The Board receives a quarterly report on the key issues relating to our employees from the Group Head of HR and a monthly report on health and safety across the Group.

We recognise that it is important to provide a channel for named or anonymous feedback from our stakeholders. We provide a whistleblowing facility for confidential reporting by our employees which is managed by an independent third-party service provider. If any call is made to this third party, either the Chief Executive or the Senior Independent Director is notified promptly of the fact and the content of the call, so that appropriate action can be taken. A number of channels for feedback from our other stakeholders are made available via our website.

The governance and Board oversight of the Group’s approach towards relevant environmental issues is facilitated by Beatrice Nicholas chairing the Climate Impact Forum meetings. Beatrice briefs the Board on the matters discussed after each meeting of the forum. Any risks identified are integrated into our risk management procedures and, if appropriate, into our strategy. The Board has put an Environmental Policy Statement in place which provides a framework for the subsidiaries to implement their own environmental policies according to the needs of each business.

The Board welcomes considered enquiries from shareholders and other stakeholders at any time.

The primary points of contact with the shareholders are the Chief Executive, the Finance Director and me. Peter Lynas, the Senior Independent Director, is available to all shareholders should they have any concerns which communication through the normal channels of Chairman, Chief Executive and Finance Director has failed to resolve, or for which contact through the normal channels would be inappropriate.

The Company Secretary also responds to any requests for information received from shareholders.

How Cohort applies this principle

The Board and Group’s approach to risk is set out in the Audit Committee report and in the Risk Management and Principle risks sections.

Climate-related risks and opportunities are reported in the Non-financial and sustainability information statement and, in practice, are integrated into the day to ray risk reporting and management process by each subsidiary as appropriate.

Such systems are designed to manage rather than eliminate risks and can provide only reasonable and not absolute assurance against material misstatement or loss. Each year, in addition to our internal risk management process, the Audit Committee and the Board reviews any material risks potentially affecting the Group in discussions with the external auditor.

On the recommendation of the Audit Committee, the Board has determined that an internal audit function is not required due to the relatively small size of Cohort and the high level of Director review and authorisation of transactions. The Board will keep this matter under review as the Group develops.

A comprehensive budgeting process is completed once a year and is reviewed and approved by the Board. In addition, the Group conducts quarterly re-forecasts. The Group’s results, as compared against budget and the latest quarterly forecast, are reported to the Board on a monthly basis and discussed in detail at each meeting of the Board.

The subsidiary balance sheets are reviewed in detail on a quarterly basis by the Cohort Finance team.

How Cohort applies this principle

The Board of Cohort plc is highly experienced in the defence market. Through the operation of the Board and the Group Executive, which comprises the subsidiary Managing Directors and the Cohort plc Executive Directors and function heads, the Board is able to monitor the business and respond in a timely manner to issues and opportunities as and when they arise.

As at 30 April 2025, the Board of Directors comprised of the Chairman, two Executive Directors, Andrew Thomis and Simon Walther, and three Non-executive Directors, Peter Lynas, Ed Lowe and Beatrice Nicholas.

The Board considers that Peter Lynas, Ed Lowe and Beatrice Nicholas are independent Non-executive Directors.

The mix of skills and experience brought to the Board by the Directors is set out under principle 7 below and each year the Nomination Committee considers if this is right mix of experience, skills and capabilities to oversee the execution and delivery of our strategy in order to create sustainable value for shareholders. This year, following the growth and expansion of the Group, we identified a requirement for more operational support and we are in the process of recruiting a senior operational executive. For further information, see the report of the Nomination Committee.

All Directors are subject to annual re-election by shareholders.

The Board has established three Committees: Audit, Remuneration and Nomination which are outlined in Principle 7.

Attendance at Board & Committee Meetings is presented on page 57 of the Governance report.

The Board has also established a Climate Impact Forum, chaired by Beatrice Nicholas.

See Sustainability for more details.

Raquel McGrath acts as Secretary to the Board and its Committees. The Company Secretarial department supports the Board, ensuring good information flows and advising on all corporate governance matters.

How Cohort applies this principle

The Board has ultimate responsibility for corporate governance, which it discharges either directly, or through its Committees as outlined above and through the management structure outlined below.

Group management

The Cohort Board holds at least nine scheduled meetings per calendar year; in addition, the Board meets to conduct business and strategic reviews which are not recorded as formal Board meetings. The Board also holds regular ad-hoc discussions as required to consider particular issues. As a Board, we visit each of the subsidiaries at least once a year and individual Non-executive Directors will visit subsidiaries as required to assist with matters within their area of expertise. The Non-executive Directors and I also meet at least once a year without the Executive Directors present.

The Board is supported by its Committees as outlined below:

- The Audit Committee – Terms of Reference

The Audit Committee consists of two independent Non-Executive Directors, Peter Lynas (Chair), Edward Lowe and Beatrice Nicholas, in accordance with the Code. The Audit Committee’s role is set out within the Audit Committee Report.

- The Remuneration Committee – Terms of Reference

The Remuneration Committee consists of three Independent Non-executive Directors, Ed Lowe (Chair), Peter Lynas and Beatrice Nicholas, and the Chairman, Nick Prest. The composition of the Remuneration Committee is in accordance with the Code. All four members have considerable experience of remuneration schemes for senior executives in public and private companies, both large and small, as well as a substantial combined shareholding in the Company, and the collective view of the Board is that the present composition of the Committee benefits the Company and its shareholders. The Committee’s Role is set out in the Remuneration Committee Report.

- The Nomination Committee – Terms of Reference

The Board established a Nomination Committee in April 2021. The Nomination Committee comprises Nick Prest as Chair and two independent Non-executive Directors, Peter Lynas, Edward Lowe and Beatrice Nicholas. The Nomination Committee's role is set out in the Nomination Committee report. The Committee meets as required.

The Board receives a detailed monthly Board report comprising individual reports from each of the Executive Directors and the subsidiary managing directors, together with any other material necessary for the Board to hold fully informed discussions to discharge its duties, including the review of Company strategy to ensure this aligns with creating shareholder value. It is the Board’s responsibility to formulate, review and approve the Group’s strategy, budgets, major items of expenditure and commitment, major contract bids, acquisitions and disposals.

A full schedule of the matters reserved for the Board can be viewed on the Cohort website.

The Group Executive Committee meets at least four times per calendar year, comprising Cohort Executive Directors, subsidiary managing directors, and Group heads of strategy, communications, commercial, legal and human resources.

Subsidiary management

There are monthly executive management meetings involving the senior management of each subsidiary. Cohort Executive Directors attend subsidiary executive management meetings on a regular basis and sit on the Board of each subsidiary. In addition to the matters reserved for the Board, there is a formal Delegation of Authority Policy which is approved by the Board and provides a framework for effective decision making at the subsidiary level together with appropriate Board oversight.

In addition to the two Executive Directors of Cohort, two independent Non-executive Directors with experience of the Australian defence sector have been appointed to the board of EM Solutions and board meetings are held four times each year.

The Board has a broad range of skills, with particularly deep experience in the defence sector. The balance of skills and experience of the Board is presented on page 57 of the Governance report and the Board biographies give an indication of the breadth of skills and experience.

Cohort is predominantly a defence company and collectively the Board has experience of engineering, financial, commercial, sales and marketing and general management functions in a range of defence companies, large and small, operating in and supplying to a large number of countries throughout the world. We consider this collective experience to be an important contributor to Cohort.

Each member of the Board takes responsibility for maintaining their skill set, which includes formal training and attending relevant events and roundtables including on matters within the remit of the Board’s committees. The Board is advised by the Group’s internal experts in matters relating to cyber-security and it has also commissioned an independent review for external assurance.

The Company Secretary, a qualified solicitor, is responsible within the Company for advising the Board on its legal and regulatory responsibilities and on corporate governance matters. The Company Secretary and the Cohort Group Head of Human Resources also advise the Non-executive Directors independently of the Executive Directors on any matter in which the Executive Directors are personally interested, for example their own remuneration.

When necessary, external advice is sought, on legal, personnel, financial and governance matters. The primary sources are the Company’s NOMAD and the Company’s lawyers. During the reporting year, the Board received advice from the Company’s lawyers on the acquisition of EM Solutions and the associated placing.

We also commission tailored executive coaching for our senior executives from time to time.

How Cohort applies this principle

Our approach to evaluation of the Board’s effectiveness is that it should be a continuous process rather than just a periodic event. It is the Chairman’s responsibilty to stimulate and orchestrate this process, consulting colleagues both individually and collectively. As part of the process, the Chairman must obtain the views of colleagues on his own performance.

It is important that this largely informal process is supplemented periodically with a formal review of Board performance from time to time as recommended by the QCA Code. The Board completed its first external evaluation facilitated by Independent Audit Limited (IAL), an independent third-party organisation in 2022. The Board will continue to evaluate Board effectiveness informally on an ongoing basis and will report any relevant findings in the Company’s Annual Report. The Board will also consider conducting external Board evaluations periodically.

This year the Board has continued to evolve and has carried out an internal review of its performance. In 2024/25 areas of focus for the Board have included the Group’s strategy process, the management and reporting of risk and the application of the 2023 QCA Code.

The Board has also undertaken its annual review of its succession planning, including timelines where appropriate. This was considered in a meeting of the Nomination Committee. This year the Nomination Committee identified that additional executive operational support was required. For 2025/26 the Board will continue to review and refine the Group’s strategy process, approach to M&A and the opportunities for shared value creation within the Group.

How Cohort applies this principle

The Remuneration report sets out how our remuneration policy supports long-term value creation, our purpose, strategy, and culture. This policy was implemented in 2021 and material shareholders were consulted prior to its implementation. The Remuneration Committee has worked closely with the Audit Committee to review the Group’s outcomes against the performance targets set under the executive remuneration scheme and the Board has reviewed the overall outcome of the application of the policy each year and is satisfied that it is incentivises responsible long-term performance and growth of the Group.

Our Remuneration report is put to an annual advisory vote. This received strong support at the 2024 AGM with more than 99% of votes cast in favour.

The Company currently offers two all employee share schemes for UK employees (a Save as You Earn and a Share Incentive Plan) and a discretionary Company Share Option Plan for awards to senior management who do not participate in the LTIP. The Company intends to relaunch the SAYE and CSOP schemes which both expire during the course of the current financial year and to offer a Restricted Share Plan to senior management who do not participate in the LTIP. In accordance with this principle of the 2023 QCA Code, the Company will put these new schemes to a shareholder vote at the 2025 AGM.

More details will be available in the notice of meeting.

How Cohort applies this principle

The Board communicates how the Company is governed and how it is performing by maintaining a dialogue with shareholders and other stakeholders through the mechanisms described in Stakeholder Engagement section.

The Company uses the Annual Report and Accounts, the AGM, the Interim Report, the website (www.cohortplc.com), social media, webcasts and email news alerts to provide information to shareholders. The Company also meets with its institutional shareholders and analysts and receives feedback from its institutional shareholders, via its Nomad, Investec, on a regular basis.

The reports to shareholders of the Audit, Nomination and Remuneration Committees are shown separately.

Further disclosures required under QCA Principle 10:

- Audit Committee Report

- Remuneration Committee Report

- Nomination Committee Report

- Documents & Reports

- Historical annual reports & notices of general meetings