Chairman’s statement

With a record order book alongside our net funds and market position, this provides a robust foundation for future organic growth, and the ability to make further strategic additions to the Group as we did this year.

Highlights presentation video

Financial highlights FY2024/25

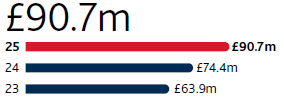

Adjusted* operating profit (£m)

Order intake (£m)

Net funds (£m)

Statutory profit before tax (£m)

* Adjusted figures exclude the effects of marking forward exchange contracts to market value, other exchange gains and losses and amortisation of other intangible assets.

Operational highlights FY2024/25

- Record revenue, adjusted operating profit, and closing order book. Net funds exceeded market expectations.

- Adjusted operating profit of £27.5m (2024: £21.1m) on revenue of £270.0m (2024: £202.5m).

- Underlying order intake up by 11% (excluding a large, long-term Royal Navy order of £135m secured in 2023/24).

- Record order book of £616.4m, with deliveries extending out to mid-2030s.

- Dividend growth ahead of expectations at 10%; the dividend has been increased every year since the Group’s IPO in 2006.

- Acquisition of EM Solutions for an enterprise value of £75m completed 31 January 2025; positive contribution in first three months of ownership.

Measuring our progress

Indicates the change in total Group revenue compared with prior years.

Why is it important?

Revenue growth gives a quantified indication of the rate at which the Group’s business activity is expanding over time.

Results

Comment on results

The Group revenue was up on last year, increasing from £202.5m to £270.0m with initial contributions from EM Solutions of £6.7m and ITS of £1.5m. Excluding these acquisitions, the underlying Group revenue was higher by 29%, with marked growth in both divisions, especially Communications and Intelligence.

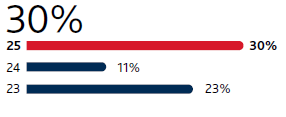

Change in Group operating profit before exceptional items, amortisation of other intangible assets, research and development expenditure credits and non-trading exchange differences, including marking forward exchange contracts to market.

Why is it important?

The adjusted operating profit trend more accurately captures the business’ contribution to shareholder value than a pure cash measure. It is also an indication of whether additional revenue is being gained without profit margins being compromised.

Results

Comment on results

On the back of the higher revenue, the trading result of the Group improved by a broadly similar level. This included an initial contribution from acquisitions of ITS (£0.5m) and EM Solutions (£1.9m). Excluding these acquisitions, the underlying Group adjusted operating profit was higher by 19%, driven by the Communications and Intelligence division.

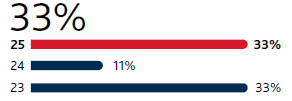

Orders for the next financial year expected to be delivered as revenue, presented as a percentage of market revenue forecasts for the year as at 30 April 2025.

Why is it important?

Order book visibility, based on expected revenue during the year to come, provides a measure of confidence in the likelihood of achievement of future forecasts.

Results

Comment on results

This is broadly consistent with the last three years, reflecting the continuing progress in the size and longevity of the order book, with orders now stretching out to mid-2030s. The slight decrease in order cover is mostly at MCL within the Communications and Intelligence division, which historically has short visibility but entered the last financial year with a relatively high order book. The order book cover for 2025/26 had further increased to over 85% by mid-July 2025.

Annual change in earnings per share, before exceptional items, amortisation of other intangible assets and non-trading exchange differences including marking forward exchange contracts to market, all net of tax.

Why is it important?

Change in adjusted earnings per share is an absolute measure of the Group’s return to shareholders (net of tax and interest).

Results

27%

Comment on results

The 27% increase is a result of a 30% increase in the adjusted operating profit and a lower tax rate, due to higher overseas R&D credits. These factors were partially offset by the dilution effects of the share placement undertaken during the year.

Net cash generated from operations (net of interest and net capital expenditure) before tax as compared to the profit before tax and interest, excluding amortisation of other intangible assets over a rolling four-year period.

Why is it important?

Operating cash conversion measures the ability of the Group to convert profit into cash.

Results

Comment on results

The conversion in the last year improves a high conversion ratio of the last two years and was again a result of strong cash control in both divisions. We expect the cash conversion in the coming year to decline slightly as we see some unwinding of the current strong working capital position in the Sensors and Effectors division.

Total sales to markets outside the UK, Australia, Germany and Portugal.

Why is it important?

International markets are important to the organic growth of the business and reduce our dependence on domestic markets.

Results

Comment on results

The increase in 2025 export revenue is driven by higher export sales in Sensors and Effectors, especially for naval customers of SEA and ELAC SONAR.

Download full report